Advancing growth in the European HIS market

Although most European hospitals have some kind of information system in place, very few have a fully integrated and functional hospital information systems (HIS) solution installed. Increasing accountability pressures on the government and regulatory authorities to garner more investments into healthcare IT adoption is boosting the HIS market potential.

New analysis from Frost & Sullivan, Hospital Information Systems Market in Europe, finds that market earned revenues of over $3.4 billion in 2008 and estimates this to reach $4.26 billion in 2015. In this research, Frost & Sullivan's expert analysts thoroughly examine complete and partial HIS solutions for clinical, administrative and financial applications in small-, medium-, and large-sized hospitals in the region.

“Government and regulatory authorities are compelled to increase investments into healthcare automation due to political pressure as well as public demand,” says Frost & Sullivan Senior Research Analyst S.Priyan. “A significant part of the government’s budget allocation goes towards healthcare, with the healthcare expenditure versus the gross domestic product (GDP) of the countries growing, worldwide.”

The growth rate in this market is considerably lower because of the decreasing number of potential end users year after year. Additionally, the market’s penetration rate has almost reached its saturation level. Currently, the annual maintenance and replacements systems are the main sources of revenues for the vendors. Future revenues will also mainly depend on the recurring revenues from annual support and maintenance and replacement systems.

The challenge lies in the lack of adequate adaptable and flexible systems, leading to complex system architecture, reducing the utilisation rates of HIS systems among hospital staff.

“The workflow environment in a hospital is more complex than other sectors and the data processing workflow could extend from several departments to across sectors and territories,” notes Priyan. “Therefore, it is vital for the systems to be highly flexible and adaptable and encompass powerful, effective and user-friendly tools to support the end users.”

Moreover, the large number of potential people to access or change the medical data makes security concerns an issue.

“Despite low investments from private and non-profit hospitals, their numbers are on the rise and vendors should pitch for low-cost systems in these sectors,” concludes Priyan. “Vendors should promote low-cost systems such as remotely hosted systems and application service provider (ASP) systems to successfully cater to high potential consumers such as private

and non-profit hospitals.”

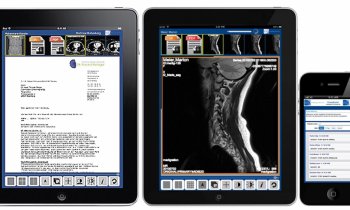

Picture: Siemens

02.09.2009